News

SilverCrest Announces High-Grade Underground Sampling Results for the Babicanora Vein

- 3.9 Metres at 9,310 gpt AgEq

- 3.5 Metres at 3,444 gpt AgEq

- 1.8 Metres at 7,537 gpt AgEq

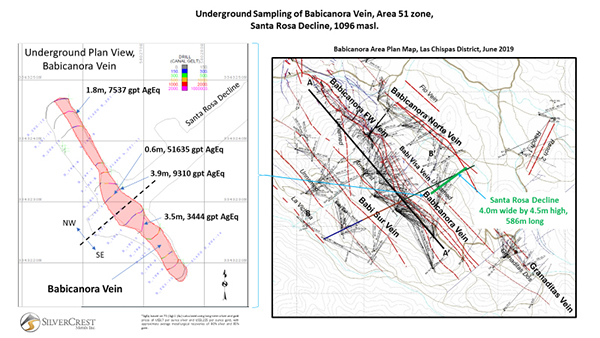

VANCOUVER, BC – July 10, 2019 - SilverCrest Metals Inc. (“SilverCrest” or the “Company”) is pleased to provide the first underground sampling results for the Babicanora Vein at its Las Chispas Project (“Las Chispas”) located in the state of Sonora, Mexico. On June 20, 2019, the Company intersected the Babicanora Vein in the high-grade Area 51 zone with the newly constructed Santa Rosa Decline and proceeded with development (3.5 metres by 3.5 metres drift) along the strike of the vein for approximately 35 metres (see attached Figures). During this development drifting, a total of 133 channel samples were collected from blast faces, analyzed, and compiled to determine the estimated average vein width and grade (see table below). Compilation shows an average vein width in this area of 2.6 metres, which is comparable to the resource block model for this area. Compilation of underground (“U/G”) sample results within the vein shows an uncut undiluted weighted average grade of 13.70 grams per tonne (“gpt”) gold (“Au”) and 1,107.6 gpt silver (“Ag”), or 2,132 gpt silver equivalent (“AgEq”, defined in table below). For comparison purposes, the estimated grade from the current resource block model for the mined area (undiluted but with capping applied) is 3.60 gpt Au and 592 gpt Ag, or 863 gpt AgEq. While the difference between the results is significant, the sampling covers a small part of the resource for the Babicanora Vein and should not be considered representative. For additional information, please refer to “Technical Report and Preliminary Economic Assessment for the Las Chispas Property, Sonora, Mexico” (“PEA Technical Report”) with an effective date May 15, 2019 and available on SEDAR at www.sedar.com.

N. Eric Fier, CPG, P.Eng, and CEO, remarked, “We are pleased with these initial positive underground high-grade results but caution that they are preliminary in nature and should not be considered representative of an increase in the overall Babicanora Vein resource estimation. That being said, these results represent a significant first step toward understanding the grade variability and potential upside of the deposit as we continue to de-risk the project. Positive results are also supported by other work completed to date on drill hole comparisons to underground sample results, assaying methodology, specifically screen metallics as noted in the recent PEA Technical Report, and metallurgical test-work where comparative grade increases are noted. The Company plans to continue its efforts to understand the grade behavior through additional U/G face sampling, geostatistical analysis, ongoing metallurgical testing to determine how best to apply representative grades to resource estimation for the ongoing Feasibility Study. We are hopeful that the information generated from this work could lead to positive adjustments to grade estimation. The Company plans to continue in-vein drifting as part of a larger effort to complete approximately 1,500 to 2,000 metres of total U/G development for the remainder of 2019.”

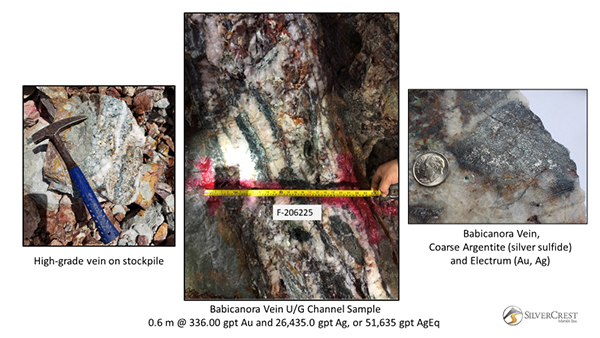

The most significant result for this release is sample number 194-4 NW 1.5, which channel sampled 3.9 metres (estimated true width) grading 62.66 gpt Au and 4,610.2 gpt Ag, or 9,310 gpt AgEq. Also noteworthy are samples 195-5 SE 1.5 at 3.5 metres grading 16.69 gpt Au and 2,192.0 gpt Ag, or 3,444 gpt AgEq, and 201-11 NW 0.5 at 1.8 metres grading 53.18 gpt Au and 3,548.8 gpt Ag, or 7,537 gpt AgEq. The following table for this release summarizes the most significant continuous channel samples (uncut, undiluted) collected 0.5 and 1.5 metres above the mined floor level;

Babicanora Vein, Area 51 zone, Underground Channel Sample Results:

| U/G Face Sample Number(1) |

From (m) |

To (m) |

Interval (m) |

Au gpt |

Ag gpt |

AgEq(2) gpt |

| 194-4 NW 1.5 | 0.0 | 3.9 | 3.9 | 62.66 | 4,610.2 | 9,310 |

| Includes | 0.6 | 1.2 | 0.6 | 336.00 | 26,435.0 | 51,635 |

| 194-4 SE 1.5 | 0.0 | 4.1 | 4.1 | 13.91 | 708.6 | 1,752 |

| Includes | 0.6 | 1.2 | 0.6 | 41.30 | 2,940.0 | 6,038 |

| Includes | 2.6 | 3.1 | 0.4 | 36.20 | 526.0 | 3,241 |

| 195-5 SE 0.5 | 0.0 | 3.2 | 3.2 | 12.89 | 799.2 | 1,766 |

| Includes | 0.0 | 2.3 | 2.3 | 17.35 | 1,085.0 | 2,386 |

| 195-5 SE 1.5 | 0.0 | 3.5 | 3.5 | 16.69 | 2,192.0 | 3,444 |

| Includes | 0.0 | 2.6 | 2.6 | 21.60 | 2,790.0 | 4,410 |

| 195-5 NW 0.5 | 0.0 | 2.2 | 2.2 | 5.91 | 767.5 | 1,211 |

| Includes | 0.5 | 1.5 | 1.0 | 11.50 | 1,290.0 | 2,153 |

| 195-5 NW 1.5 | 0.0 | 2.1 | 2.1 | 3.06 | 580.2 | 809 |

| Includes | 0.6 | 1.4 | 0.8 | 8.04 | 989.0 | 1,592 |

| 196-6 NW 0.5 | 0.0 | 1.7 | 1.7 | 2.62 | 451.0 | 648 |

| Includes | 1.2 | 1.7 | 0.5 | 2.50 | 945.0 | 1,133 |

| 196-6 NW 1.5 | 0.0 | 1.9 | 1.9 | 1.56 | 399.6 | 517 |

| 196-6 & 7 SE 0.5 | 0.0 | 3.3 | 3.3 | 6.41 | 570.7 | 1,052 |

| Includes | 0.0 | 0.5 | 0.5 | 0.05 | 1,725.0 | 1,729 |

| 196-6 & 7 SE 1.5 | 0.0 | 3.2 | 3.2 | 18.74 | 459.3 | 1,865 |

| Includes | 0.0 | 1.5 | 1.5 | 38.40 | 520.0 | 3,400 |

| 197-7, 8 & 9 NW 0.5 | 0.0 | 1.5 | 1.5 | 2.46 | 377.9 | 563 |

| 196-6 NW 0.5 | 0.0 | 1.8 | 1.8 | 1.92 | 319.2 | 463 |

| 198-8 SE 1.5 | 0.0 | 3.3 | 3.3 | 1.27 | 388.7 | 484 |

| Includes | 0.6 | 1 | 0.4 | 7.91 | 921.0 | 1,514 |

| 198-8 SE 0.5 | 0.0 | 2.3 | 2.3 | 2.67 | 252.8 | 453 |

| 199-9 SE 0.5 | 0.0 | 2.7 | 2.7 | 5.82 | 448.7 | 885 |

| 200-10 NW 1.5 | 0.0 | 1.4 | 1.4 | 7.04 | 478.6 | 1,006 |

| Includes | 0.0 | 0.5 | 0.5 | 19.75 | 1,065.0 | 2,546 |

| 200-10 NW 0.5 | 0.0 | 1.7 | 1.7 | 7.20 | 699.7 | 1,240 |

| Includes | 0.5 | 0.9 | 0.4 | 27.8 | 1,750.0 | 3,835 |

| 200-11 NW 1.5 | 0.0 | 2.1 | 2.1 | 14.77 | 1,541.9 | 2,650 |

| Includes | 1.4 | 1.8 | 0.4 | 48.50 | 4,710.0 | 8,348 |

| 201-11 NW 0.5 | 0.0 | 1.8 | 1.8 | 53.18 | 3,548.8 | 7,537 |

| Includes | 0.8 | 1.3 | 0.5 | 135.00 | 7,820.0 | 17,945 |

| 202-12 NW 0.5 | 0.0 | 2.5 | 2.5 | 15.27 | 1,426.0 | 2,571 |

| Includes | 1.5 | 1.9 | 0.4 | 90.50 | 7,640.0 | 14,428 |

| 202-12 NW 1.5 | 0.0 | 1.9 | 1.9 | 10.34 | 1,336.1 | 2,014 |

| Includes | 1.3 | 1.9 | 0.6 | 33.00 | 4,200.0 | 6,675 |

| 203-13 SE 1.5 | 0.0 | 2.9 | 2.9 | 3.74 | 465.5 | 746 |

| Includes | 1.1 | 1.4 | 0.3 | 1.95 | 1,165.0 | 1,311 |

| 203-13 SE 0.5 | 0.0 | 2.5 | 2.5 | 21.73 | 1,230.6 | 2,861 |

| Includes | 1.0 | 1.75 | 0.75 | 52.60 | 2,460.0 | 6,405 |

| 204-14 SE 1.5 | 0.0 | 2.3 | 2.4 | 4.55 | 612.5 | 953 |

| Includes | 1.0 | 1.6 | 0.6 | 9.12 | 921.0 | 1,605 |

| Weighted Average without includes | 2.6 | 13.70 | 1,107.6 | 2,132 | ||

Notes: all numbers are rounded. Based on a cutoff grade of 150 gpt AgEq with no minimum width.

- 194-4 NW 1.5 means 194-4 blast number, northwest drift, 1.5 metres above mined floor level. SE is southeast drift, 0.5 metres above mined floor level.

- AgEq based on 75 (Ag):1 (Au) calculated using long-term silver and gold prices of US$17 per ounce silver and US$1,225 per ounce gold, with average metallurgical recoveries of 90% silver and 95% gold.

All assays were completed by ALS Chemex in Hermosillo, Mexico, and North Vancouver, BC, Canada.

The underground intersection by the decline of the Babicanora Vein in the Area 51 zone has accelerated our understanding of the mineralization in this vein. The vein appears to have at least four phases of mineralization including: 1) Quartz Veining with coarse argentite (silver sulfide), electrum and pyrargyrite; 2) Quartz Breccia with lesser argentite; 3) Shear Zone with supergene enrichment including cerargyrite (silver oxide), clays, quartz vein fragments and calcite; and 4) adjacent Stockwork Quartz Veining, and calcite mineralization. The highest grades in the vein are found within Quartz Veining and Shear Zone mineralization. Noteworthy is the Shear Zone, which had low recovery in core drilling and may be part of the positive discrepancy reflected in higher grades from the initial U/G sampling results. Further work is required to determine the impact of Shear Zone on the overall grade of the Babicanora Vein. The Company intends to re-drill select known low core recovery areas with triple tube drilling to increase core recovery of clay-rich mineralization and help determine impact on grade estimation in the Babicanora Vein.

The Company continues its exploration program with 14 drills operating on site today. Drilling is focused on expanding mineralization and improving the resource confidence through in-fill drilling to reclassify resources as reserves for the Feasibility Study. An additional 50,000 metres of infill and expansion drilling are planned for the remainder of 2019. Other work includes the Feasibility Study expected in H1, 2020, ongoing development of the Babicanora Vein in Area 51 zone, stockpiling of high-grade material, an extensive metallurgical test program, geotechnical work and permitting for project development.

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is N. Eric Fier, CPG, P.Eng, and CEO for SilverCrest, who has reviewed and approved its contents.

ABOUT SILVERCREST METALS INC.

SilverCrest is a Canadian precious metals exploration company headquartered in Vancouver, BC, that is focused on new discoveries, value-added acquisitions and targeting production in Mexico’s historic precious metal districts. The Company’s current focus is on the high-grade, historic Las Chispas mining district in Sonora, Mexico. SilverCrest is the first company to successfully drill-test the historic Las Chispas Project resulting in numerous discoveries. The Company is led by a proven management team in all aspects of the precious metal mining sector, including taking projects through discovery, finance, on time and on budget construction, and production.

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” within the meaning of Canadian securities legislation. These include, without limitation, statements with respect to: the strategic plans, timing and expectations for the Company’s exploration and drilling programs of the Las Chispas Project, including development drifting, metallurgical test, mineralization estimates and grades for drill intercepts, permitting for various work, and optimizing and updating the Company’s resource model and preparing a feasibility study; information with respect to high grade areas and size of veins projected from underground sampling results and drilling results; and the accessibility of future mining at the Las Chispas Project. Such forward‑looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: the reliability of mineralization estimates, the conditions in general economic and financial markets; availability of skilled labour; timing and amount of expenditures related to rehabilitation and drilling programs; and effects of regulation by governmental agencies. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors including: the timing and content of work programs; results of exploration activities; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project cost overruns or unanticipated costs and expenses; and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

|

N. Eric Fier, CPG, P.Eng |

|

For Further Information: |

Neither TSX Venture Exchange nor its Regulation Services Provider (as defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Email Sign Up